As per the 2016 Stabroek Block contract, for the oil production lifecycle, from the preparation for oil production to when the oil is finally sold, the oil companies pay no taxes (see Article 15.1). The applicable income tax laws assess the Contractor’s tax due on taxable income (Article 15.3) and the Minister agrees to pay the tax assessed to the Guyana Revenue Authority on behalf of the Contractor (Article 15.4(a)). How much taxes would have been collected from the oil companies if the Stabroek contract required the oil companies to pay taxes?

Except for telecommunication companies, Guyanese businesses pay two rates of profit taxes (called corporation tax): 40% of the chargeable profits from commercial activities and 25% of the chargeable profits from non-commercial activities. Nominally, oil producing companies fall under the 25% category but they do not pay the taxes – the Government does it for them.

The oil companies also have business tax exemptions from the raw materials used to enable pumping of oil. Such items as imported steel pipes, cement, protective paints, and so on, are tax-exempt. This is in contrast to regular Guyanese businesses that are subject to taxes on listed raw materials and final profits tax. The reason for this dual tax system, one for taxation of locals and zero taxes for foreign oil companies is because section 51 of the Petroleum Exploration and Production Act 1986, over-rides Guyana’s operating tax laws.

What is even more alarming is the possibility that oil companies may be eligible to use tax receipts or certificates obtained under Article 15.5 from the Guyana Revenue Authority under Article 15.4(b), to receive a tax-credit in the US for taxes they never actually paid in Guyana.

The Contractor’s tax benefit assigned could be assessed by analysing a press release dated March 10, 2021, in which the Ministry of Natural Resources stated as of February 5, 2021 the total earned from oil in the Stabroek Block was US$267.7 million dollars. Without royalties the amount was US$246.5 million. We know that the oil companies can expense up to 75% of oil revenues and Guyana receives a 2% royalty included as an expense. Guyana and the oil companies split the remaining revenues as profit share, with each receiving 12.5 %. Using the information presented, we can assume the 12.5% profit share by the oil companies is a taxable income of US$246.5 million. If we use the 25% tax rate that applies to commercial activities in Guyana, the oil companies should have paid approximately US$62 million (25% times US$246.5 million) in taxes. This is revenue lost to Guyana with a long list of basic needs.

To put this income assignment in perspective, the average Guyanese pensioner receives about US$1,400 a year in old age pension. If we assume there are 59,000 pensioners in Guyana, then US$62 million would enable an additional payment of US$1,050 per pensioner. The pensioners during their working years contributed to building Guyana’s infrastructure by paying taxes that enabled the building of our roads and bridges, paying for the airports and other landing ports, etc. How do we explain to pensioners that the oil companies, who will make billions in US profits off oil, are allowed to use our airports, roads, wharves and other infrastructure and services for free? Pensioners who worked most of their lives to pay for Guyanese infrastructure should question this unfairness.

Guyana cannot afford to forgo US$62 million in taxes; this money is needed to cope with the added demand placed on its old social and economic infrastructures due to the addition of the oil industry to its economy.

If the oil companies’ intention is to use the tax receipt from the Government of Guyana for a foreign tax credit, the US tax laws were never intended to allow the oil corporations to double-dip. This is a very serious matter under the US tax code, section 482.

Yours faithfully

Dr. Ganga Ramdas,

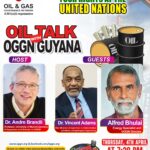

OGGN,

Retired Professor of

Business & Economics

at Lincoln University,

USA