Mr Statia should say whether Minister made required tax payments on behalf of ExxonMobil and partners for 2020, 2021, 2022 and 2023

Our letter entitled `There should be an investigation into ExxonMobil’s use of tax certificates issued…

Introduction Guyana’s Constitution identifies access to information as a right – not a privilege. Yet, for a decade and more since the Access to Information Act was passed in 2011, this right has been treated with contempt. The Office of the Commissioner of Information’s ongoing obstructionism reflects more than a question of competence – it…

The Oil and Gas Governance Network Guyana (OGGN) has previously raised critical concerns regarding the tax practices associated with the oil extraction operations of ExxonMobil and its partners – Hess Corporation and China National Offshore Oil Company (CNOOC) – in Guyana, as specified in the 2016 Petroleum Agreement, better known as the 2016 Production Sharing…

Our letter entitled `There should be an investigation into ExxonMobil’s use of tax certificates issued under Guyana’s 2016 PSA’ (Stabroek News, February 16, 2025) raised important concerns about the issuance of tax certificates and the implications for Guyana’s oil revenues. One day before its publication, the Minister of Parliamentary Affairs and Governance, Gail Texeira expressed…

The Bahamas gets 15% tax on Guyana oil revenue and Guyana (like Piggy) gets none “The OECD/G20’s Pillar Two framework mandates that all in-scope MNEs (multi-national enterprises) pay a minimum effective tax rate of 15% on profits in each jurisdiction. The Bahamas must act decisively to ensure that these taxes are collected here, rather than…

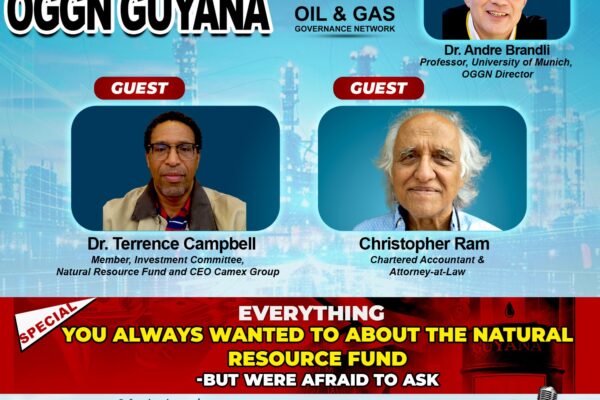

GEORGETOWN, GUYANA – Mr. Terrence Campbell, a Natural Resource Fund (NRF) Investment Committee member, this afternoon filed a judicial review application challenging the Government of Guyana’s management and transparency of the Natural Resource Fund. The application names the Attorney General of Guyana and the Senior Minister in the Office of the President with Responsibility for…

The U.S. Foreign Tax Credit (FTC) is designed to prevent double taxation by allowing individuals and corporations to offset taxes paid to foreign governments against their U.S. tax obligations. However, there is compelling evidence that ExxonMobil and its affiliates obtain tax certificates issued by the Guyana Revenue Authority (GRA) without actually paying taxes in Guyana….

The myth of an electricity subsidy in T&T and the forces behind it THE Energy Chamber of Trinidad and Tobago, which over the past few years has led an aggressive campaign to remove the ‘electricity subsidy’ for consumers in T& T, is governed by a 15-member board of directors of which seven are from the…